Hedging capabilities of cryptocurrencies against investment philosophies

Context

This project is a part of my thesis, "Bitcoin and Ethereum capabilities against investment philosophis".

Tools

This part of the thesis was develop using STATA and Excel.

Goal

This paper analyses the hedge, safe haven, and diversifier capabilities of cryptocurrencies against investment philosophies from 10/11/2017-19/07/2022, COVID-19, and the structural break period.

Methodology

- To analyze the hedging, safe haven, and diversification capabilities of Bitcoin and Ethereum for investment philosophies, it will be used the framework proposed by Ciner et al. (2013).

Where the DCC is the pairwise correlation between each of the cryptocurrencies and each of the ETFs representative of the investment philosophies, the D(r_etf,q) represents a dummy variable that is equal to one when the returns of the ETFs are lower than the lower 10th, 5th, and 1st percentiles of the ETFs. Therefore, cryptocurrencies are a diversifier for ETFs when c0 is positive and significant, a weak hedge when is zero, and a strong hedge when is negative and significant. The cryptocurrencies are a weak safe haven if c0 is negative and the c1,c2 and c3 are zero, and a strong safe haven when these coefficients are negative.

- Hedge Ratio

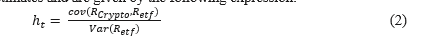

Following Kroner and Sultan (1993), the hedge ratios (HR) are computed based on the conditional volatility and covariance estimates and are given by the following expression:

Where cov(R_Crypto,R_etf) represents the conditional covariance between Bitcoin or Ethereum and the returns of the ETF, and Var(R_etf) represents the conditional variance of the ETF. Also, positive hedge values indicate reverse positions to hedge against the risk of each asset and negative values indicate that investors must take the same position for the two assets in the portfolio (Chemkha et al., 2021).

- The hedge effectiveness (HE) index is given the percentage reduction in the variance of the hedge portfolio to the unhedged portfolio (Ku et al., 2007):

Where the 〖var〗_hedged is the conditional variance of the hedge portfolio, using equation (4), and 〖var〗_unhedged is the conditional variance of the ETF. Therefore, the hedge portfolio variance is obtained by the following expression:

Where R_etf, represents the return of the individual ETF, R_CRYPTO denotes the returns of the cryptocurrency and h_t represents the HR.

Where R_etf, represents the return of the individual ETF, R_CRYPTO denotes the returns of the cryptocurrency and h_t represents the HR.

- Optimal Portfolio Weights

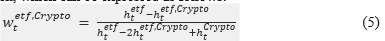

Moreover, to determine the optimal holding weight of cryptocurrencies the study will use the Kroner and Ng (1998) framework, which can be expressed as follows:

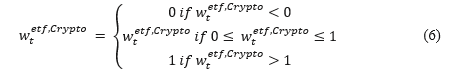

Where, h_t^etf represents the conditional volatility of the ETF returns, h_t^Crypto and h_t^(etf,Crypto)refers to the conditional volatility of the cryptocurrency at time t. Under the assumption of the absence of short selling, the mean-variance portfolio optimization approach imposes the following constraints on the optimal weight of the cryptocurrencies:

Data used

The data used was the same as the portfolio part (https://my-website-57330.stackbit.app/blog/postlayout-gy45g5jll/)

Empirical results

- Strutural break

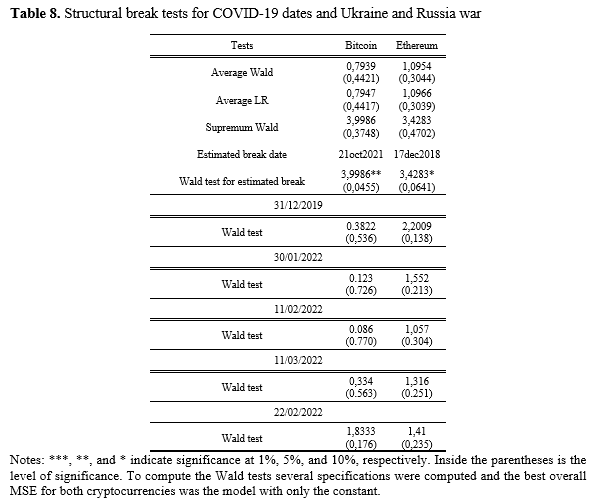

To check changes in the mean and/or other parameters of the process that produces the series, structural break tests were performed. The table shows different structural break tests with no suggested date for the model and tests with different dates for the COVID-19 pandemic and the Ukraine and Russia war (11/02/2022). Therefore, none of the dates suggested are significant for the existence of structural breaks. However, using the supremum Wald test, for both cryptocurrencies indicated that for Bitcoin there is a structural break on 21/10/2021 and for Ethereum on 17/12/2018. Using stationary tests and ARCH-LM tests, both series have a unit root at 1% for both periods and show ARCH effects for all lags, except for the ARCH(1) for Ethereum before and Bitcoin after the structural break.

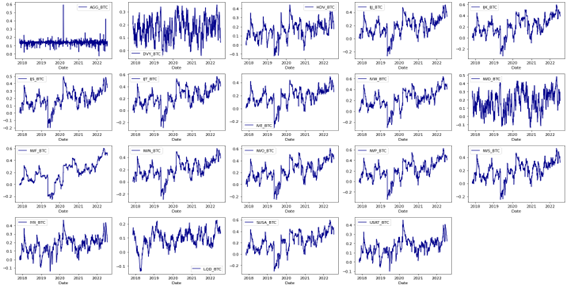

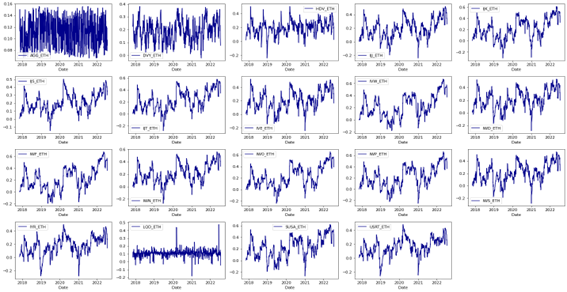

- Daily dynamic correlations for BTC, ETH and ETFs using DCC-GARCH for the full sample , respectively:

Most of the sample presents positive values, especially at the end of the sample for both cryptocurrencies. The period between 2019 and 2020 presented three moments of lower correlations, namely at the beginning of 2019, mid-2019, and the beginning of 2020, especially in the case of Ethereum. In the case of Bitcoin, the mid-2019 period presents the lowest values found, with -0.34 and -0.33 between IWP and IJK, respectively. Therefore, this period for both cryptocurrencies may suggest hedge properties for investment philosophies. Furthermore, at the beginning of the COVID-19 crisis correlations were negative and turned positive rapidly, suggesting a volatile period for correlations between cryptocurrencies and ETFs, losing possible hedge capabilities. This suggests similar findings to Corbet et al. (2020), where Bitcoin acted not as a safe haven or hedge but as an amplifier with sharp elevations of the dynamic correlations. Also, at the end of the sample, there are mostly large positive values, reaching correlations of 0.6 in the case of IWO, IWF, IVW, SUSA, IWP, and IJK for Ethereum and IVW, IWO, and IWP for Bitcoin. In addition, this illustrates a varying relationship between these assets, which is in line with Su et al. (2020).

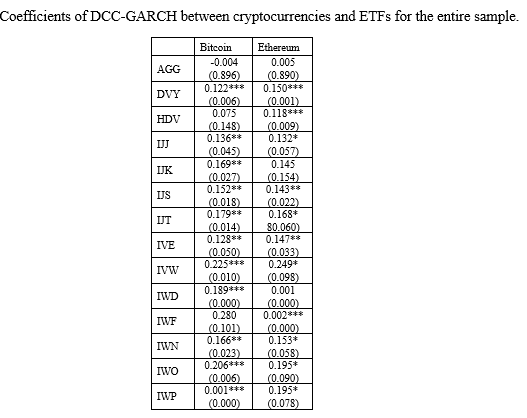

- DCC-GARCH correlation coeficients

Most of the correlations presented are positive, indicating that Bitcoin and Ethereum act not as a hedge or a safe haven but rather as a diversifier.

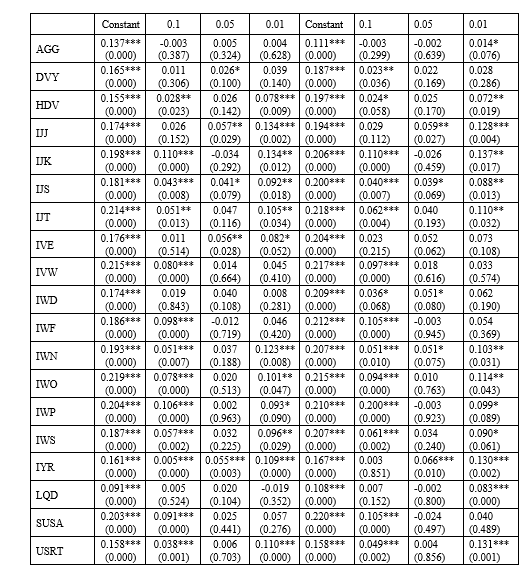

- Cinner et al. (2013)

Note: The first part of the table is related with BTC and the secound to ETH. The values presented represent the full sample

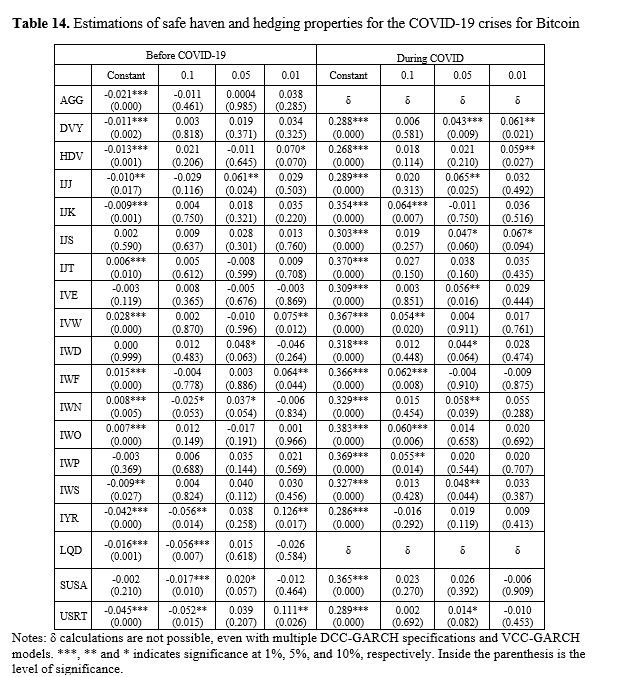

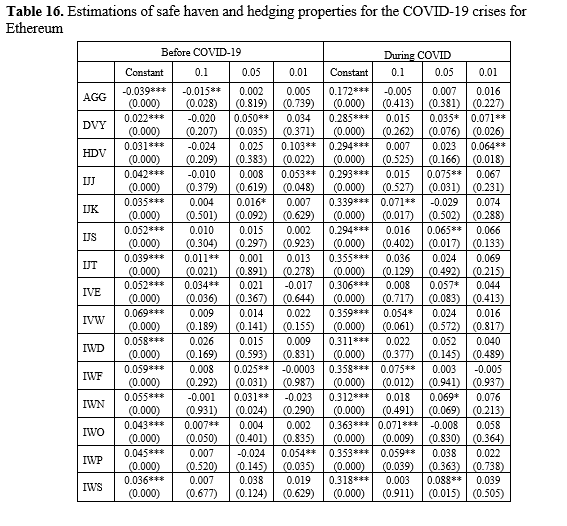

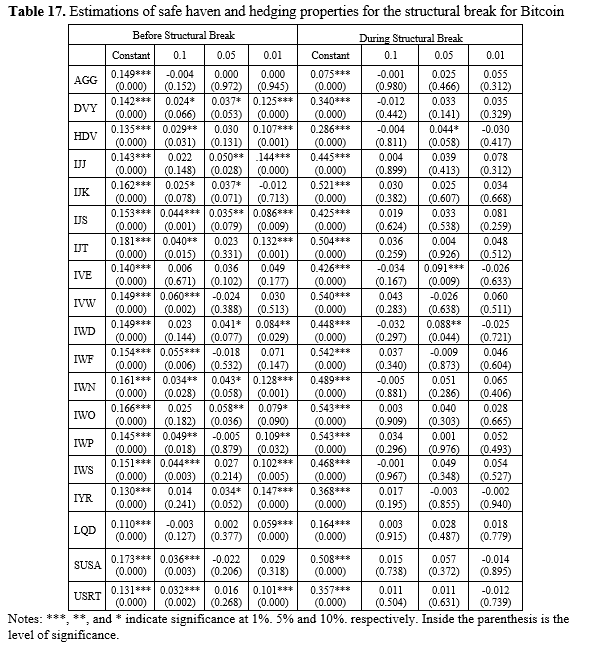

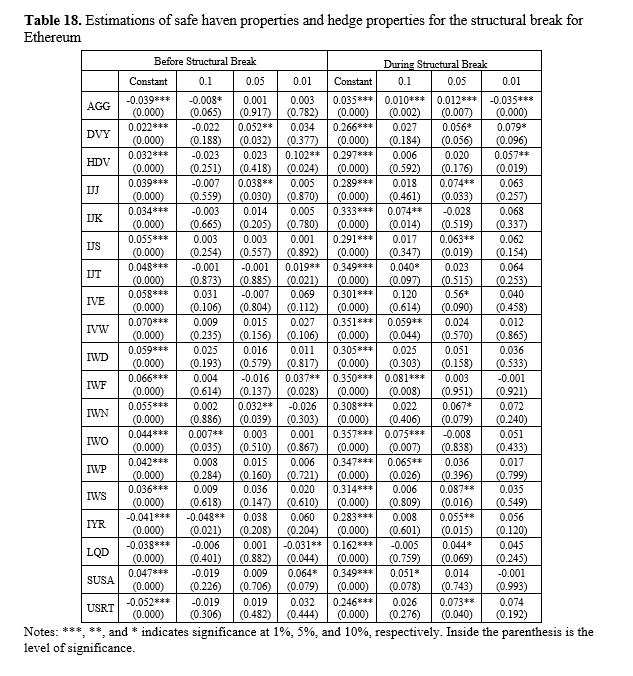

The Ciner et al. (2013) framework was used to analyze the cryptocurrency's capabilities, allowing us to conclude that using the full sample, both cryptocurrencies have diversifier capabilities for all investment philosophies. The period before the COVID-19 pandemic shows that Bitcoin had strong hedge capabilities for bonds, dividends, mid-cap value, and growth for S&P500 and Russell stocks and real estate investing. Also, it showed that it had strong safe haven capabilities for the lower 10% quartiles for real estate investing and corporate bonds. Furthermore, diversification capabilities also improved for other investment capabilities, apart from ESG investing, mid-cap growth from the Russell index, and for small-caps from the S&P500 index where it lost diversification abilities. During COVID-19, Bitcoin lost hedge and safe haven capabilities, being just a diversifier. In the case of Ethereum, it became a hedge for bond and real estate investors and a safe haven for the lower 10% quartiles in the case of IYR and AGG and the lower 1% quartiles of corporate bonds. Moreover, it had better diversification capabilities than the full sample model. Besides, it also lost the hedge and safe haven properties during the pandemic and lowered the diversifier properties given by bigger constant coefficients. According to the structural breaks, Bitcoin was a diversifier before the break, and after the diversification, capabilities lowered apart from AGG, where it became a better diversifier. For Ethereum, it acted as a hedge for dividend and real estate investors and a safe haven at 10% lower quartiles for bond investors and 1% lower quartiles for corporate bonds, and it showed better diversification abilities when compared with the full sample. However, after the structural break, it was only a diversifier. The results are in line with Conlon et al. (2020), Dutta et al. (2020), Maitra et al. (2022), Choi and Shin (2022), and Corbet et al. (2020), supporting the non-safe haven capabilities and the support of the diversifier capabilities during the pandemic. They contradict Jeribi et al. (2021) and Mariana et al. (2021) that suggest safe haven capabilities during this period. Overall, these results support the conclusions of Bouri et al. (2017), Sha and Song (2021), and Marobhe (2022) as a diversifier. Also, the findings highlight the time-varying capabilities of cryptocurrencies which justifies the need for dynamic approaches (Corbet et al. 2020).

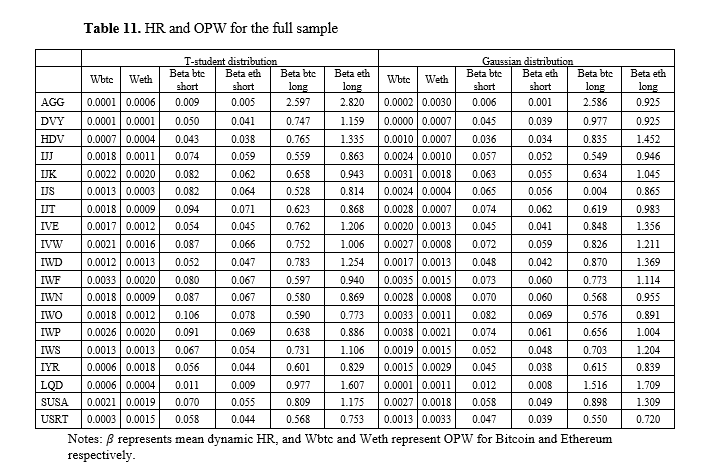

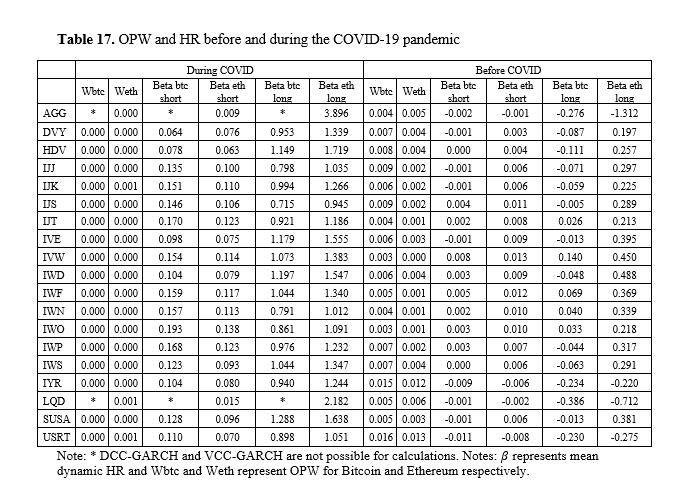

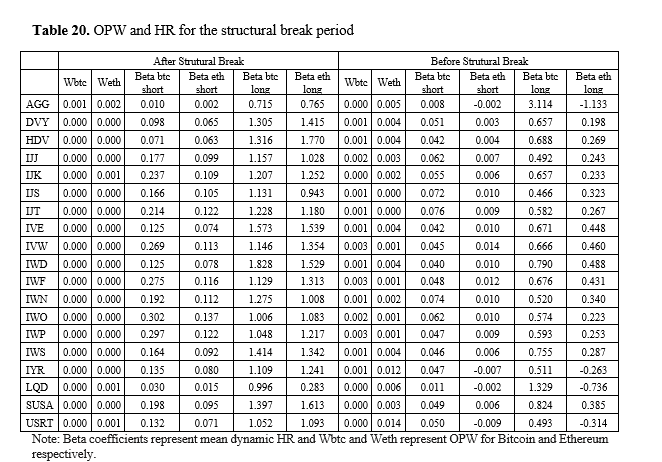

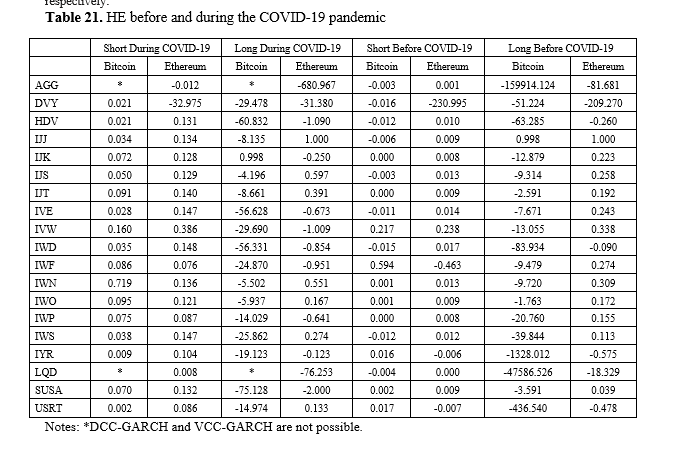

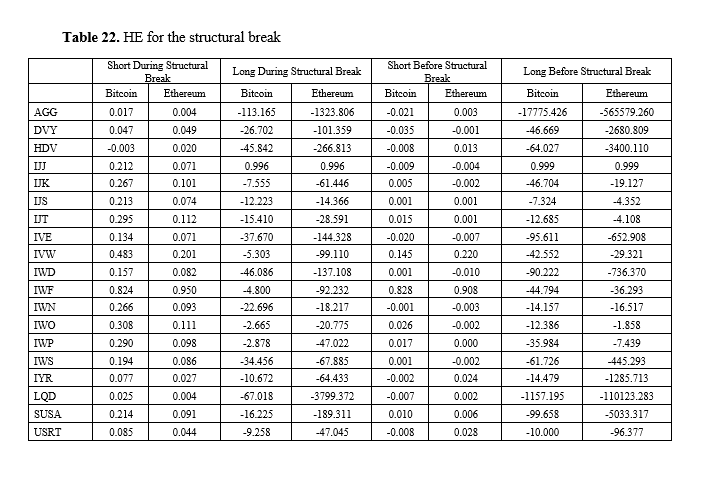

- Hedge Ratio, Optimal Portfolio Weights and Hedge Effectiveness

During the full sample, the lower HR with cryptocurrencies in a short position was obtained with bond investing. Also, the higher ratios were for mid-cap growth stocks from the Russell 2000 for Bitcoin and small-cap growth from the S&P 600. Conversely, long positions in cryptocurrencies show much higher ratios, especially for bond investors. Also, the lower ratios for long positions in cryptocurrencies were obtained for small-cap value from the S&P 600 for Bitcoin and real estate for Ethereum (USRT). OPW shows very residual values for all assets. Before the COVID-19 pandemic, most of the ratios show very residual values indicating that to hedge the different investment strategies there is a need for very low amounts of investment in cryptocurrencies. Long positions in Bitcoin show lower ratios than the ones of Ethereum. Furthermore, some ratios show negative results for both short and long positions, indicating that there is a need for both long positions in both assets. In contrast, during the pandemic, all ratios suggest a need for short positions whereas dividend investing, and bond investing show lower ratios. In long positions concerning this period, there is a significant increase in most ratios when compared with the period before the pandemic, suggesting that long positions in cryptocurrencies during the pandemic needed more investment in the other assets to hedge the position, where bond and dividend assets were the highest ratios. These findings are aligned with Chemkha et al. (2021) and Maitra et al. (2022) where the necessary coverage positions were cheaper before than after the pandemic. Furthermore, OPW is residual in both periods, which goes against what was found in Maitra et al. (2022) for both periods. For cryptocurrencies in long positions, investors constructed the hedge using the same position for S&P500 and Bitcoin before and during the pandemic in Maitra et al. (2022), which goes against most of the ETFs analyzed during the pandemic but it is in line with the results found before the pandemic, especially for most of the long positions in Bitcoin. Moreover, when compared to the full sample, it maintains the previous behavior, where short positions are more expensive with Bitcoin and long positions are more expensive with Ethereum. Before the structural break, dividends and real estate needed to be long in both Ethereum and the assets referred. Also, short positions have very low ratios, and long positions have very high ratios. After the structural break, there is an overall increase in short ratios and long ratios. Overall, the results of HR and OPW align with Guesmi et al. (2019) for short positions. Conversely, long positions in cryptocurrencies present significantly higher values than what is found in Pal and Mitra (2019). The HE also provided interesting insights. For the entire sample period, most of the values are close to zero, indicating the low effectiveness of the hedge by using cryptocurrencies in short positions. However, large-cap growth stocks from the Russell 1000 provided the highest effectiveness for both cryptocurrencies (almost 100% decline in the variance of the unhedged portfolio). With long positions, most provided non-effective hedges with most of them increasing the variance of the unhedged portfolio, however mid-cap value from the S&P400 provided almost a perfect hedge. During the pandemic, Bitcoin and Ethereum short positions improved compared with the period before, however, none provided a big enough effectiveness (apart from small-cap value from the Russell with more than 50%). For long positions, most values were negative, which provided increases in the unhedged portfolio but mid-cap value from the S&P provided a perfect hedge for Bitcoin and Ethereum (only before the pandemic). Regarding the structural break, large-cap growth from the Russell provided almost a perfect hedge for both short positions in cryptocurrencies, especially Ethereum. Also, there was an improvement before to after the structural break in short positions. Long positions showed similar characteristics to the pandemic period. Overall, the results are according to Charfeddine et al. (2020) where low effectiveness with cryptocurrencies in short positions leads to low effectiveness of the hedge, against Bouri et al. (2020) finding high effectiveness for USA-BTC (1.41%). Also, long positions in cryptocurrencies present, in most cases, negative values which go against Pal and Mitra (2019) and Maitra et al. (2022).