Portfolio optimization using the mean variance framework of Markowitz, efficient CVaR and efficient CDaR optimizations

Context

This project is a part of my thesis, "Bitcoin and Ethereum capabilities against investment philosophis".

Tools

This part of the thesis was developed using Python.

Goal

The goal of this part of my thesis was to better understand the implication of adding cryptocurrencies to personalized investment strategies, namely, value investing, growth investing, real estate, bonds and ESG.

Methodology

The portfolios optimizations as well as the performance ratios were obtained using the pyfolioopt (https://pyportfolioopt.readthedocs.io/en/latest/) model and by using the code in my github repository (https://github.com/felipeOL10/Portfolio_opt_thesis/blob/main/Portfolio_optimization.ipynb)

Note: the following pictures were taken to the teses itself.

Portfolio optimizations

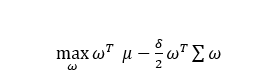

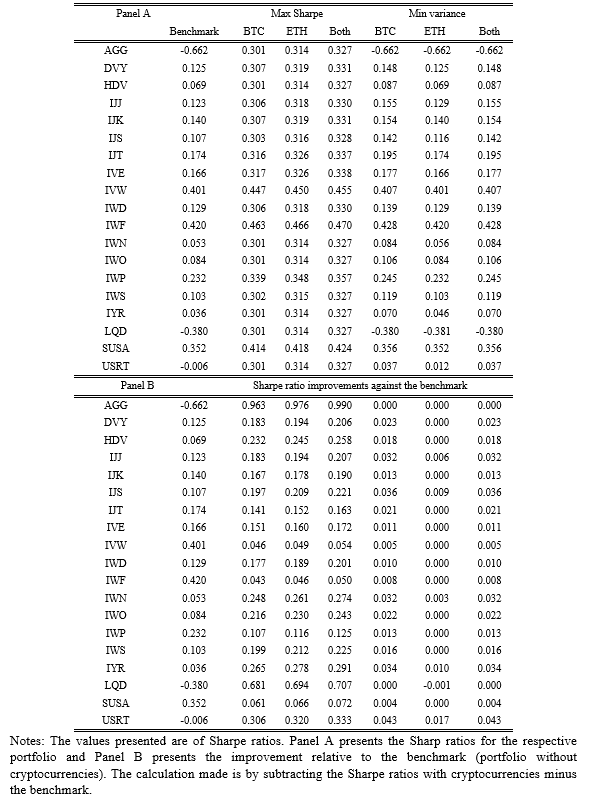

Mean variance portfolio optimization

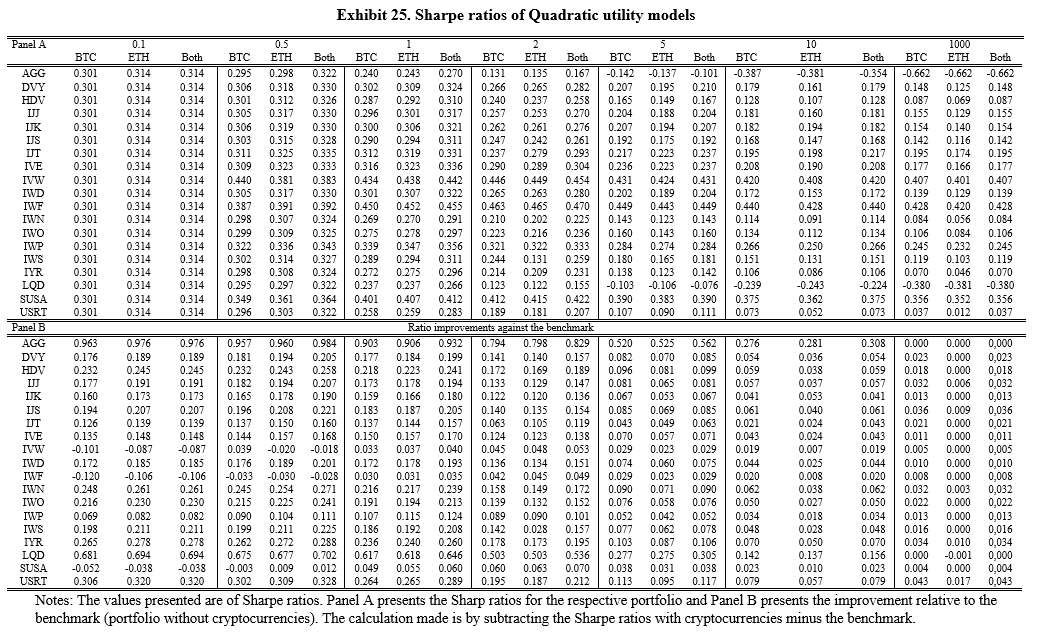

Quadratic utility

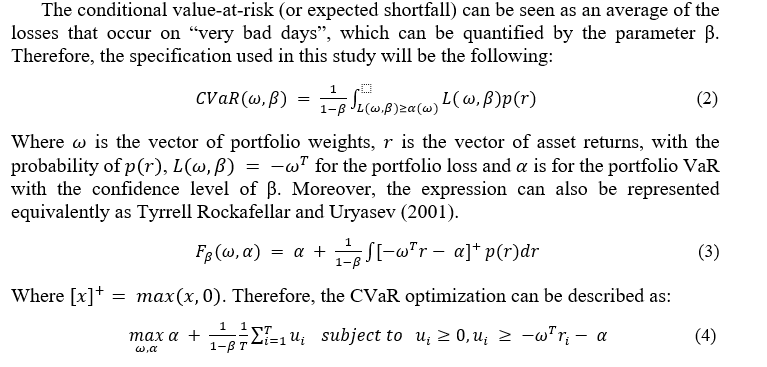

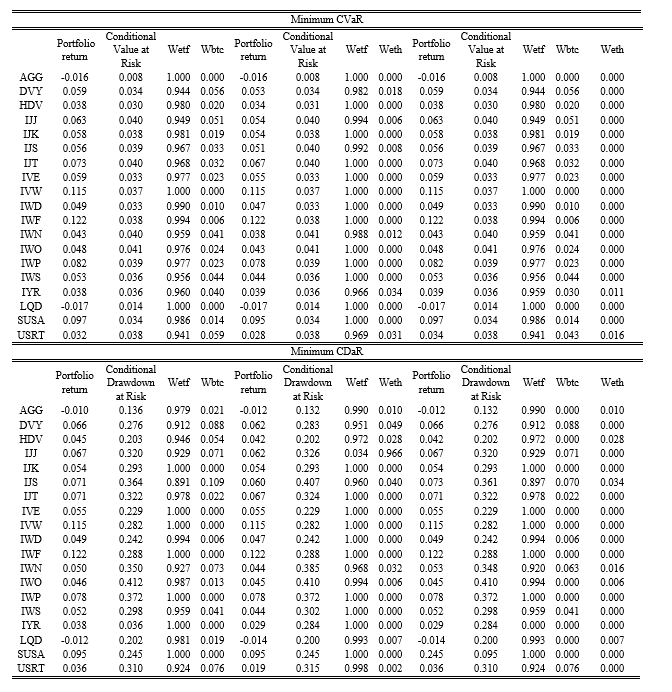

- Efficient CVaR

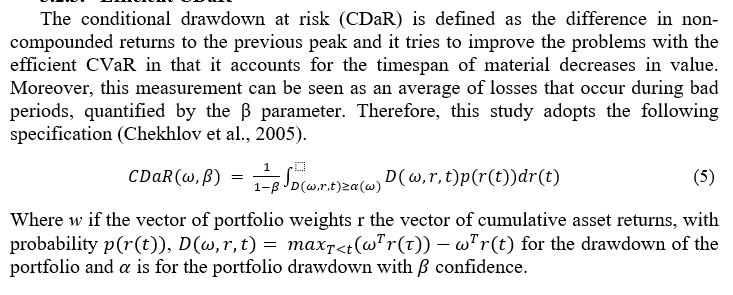

- Efficient CDaR

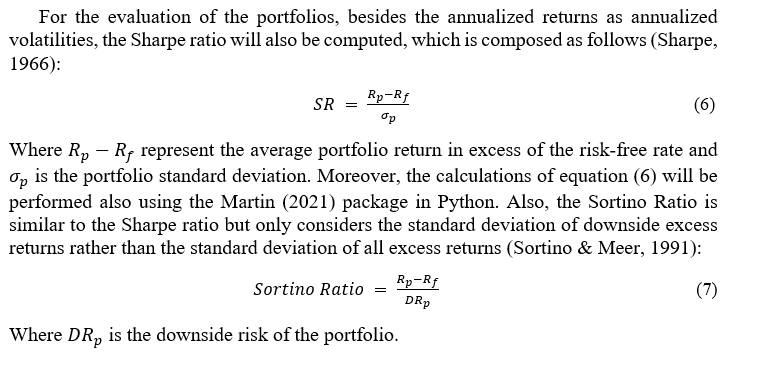

Performance ratios:

- Sharpe ratio

- Sortino ratio

Data used

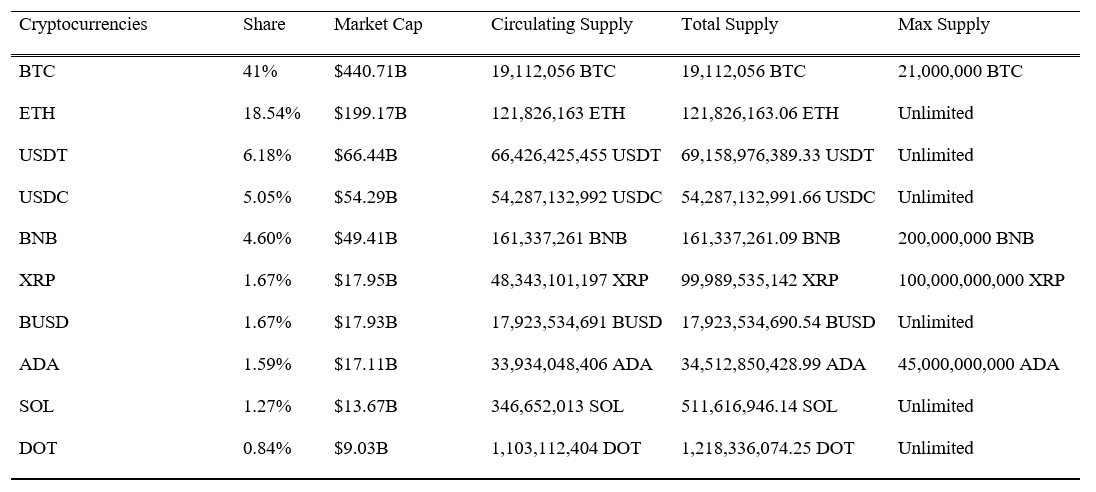

- Bitcoin and Ethereum as them were, at the time of the study, controlling close to 60% of the market share.

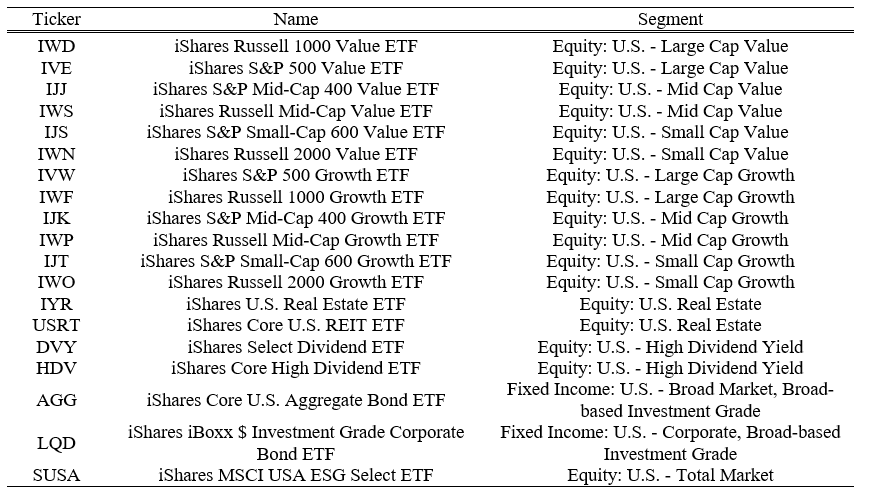

- BlackRock etf as representative of the investment philosophies

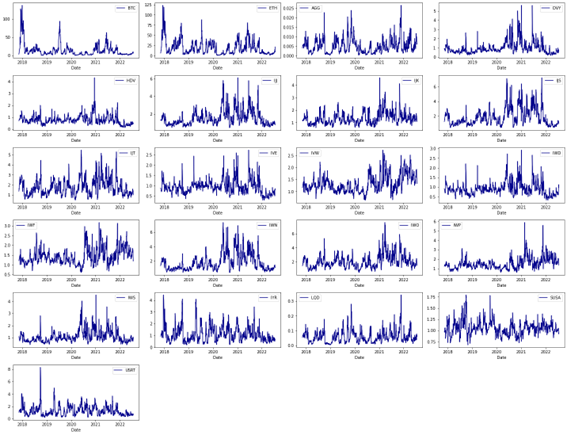

The data used was from Yahoo Finance between 10/11/2017 and 19/07/2022.

Data analysis

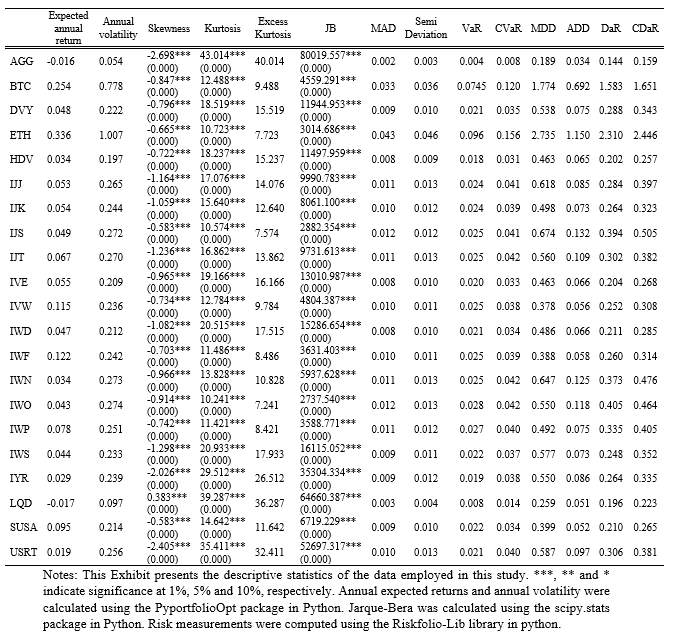

The summary statistics reveal some differences between assets. The annual return of cryptocurrencies is substantially bigger than other assets, where Bitcoin has a return of 25.4% and Ethereum of 33.6%, thus reflected in a much higher annual volatility than other assets.

Furthermore, growth investing has an average of 47.9% annual expected returns compared to value investing with an average of 31.6%. Moreover, large-cap growth was the dominating type of investment during this period with 11.8%, on average. Conversely, the small-cap value was the lowest annual return with 4.2%. In addition, mid-capitalization performed better than small-cap. In terms of annual volatility, small-cap has the highest value with 27.2% for both value and growth and large-cap was the least risky investment in terms of growth and value with 21% and 23.9% for large-cap value and growth, respectively.

In terms of the other investment types, ESG was the highest performer with 9.5%, outperforming every investment philosophy except for large-cap growth firms. However, it achieved such performance with lower annual volatility than most investment philosophies. Furthermore, dividend investing had an annual return of 4.1%, outpacing real estate and bond investing. Bond investing was the only asset class with negative returns, however, it had the lowest recorded volatility with 7.5% on average.

In general, every risk measurement shows similar results, where Bitcoin and Ethereum present higher values and bond investing the lower values, suggesting similar results as with the descriptive analysis of returns. The mean absolute deviation shows that bond investing was 0.002 and 0.003 from the mean returns (AGG and LQD, respectively), and Bitcoin and Ethereum were 0.033 and 0.043 from the mean. Looking at the downside risk of an investment, measurements such as semi-deviation, Value at Risk (VaR), Conditional Value at Risk (CVaR) or expected shortfall (ES), Drawdown at Risk (DaR), and Conditional Drawdown at Risk (CDaR) can be very informative. In terms of the semi-deviation, it looks at the dispersion of an asset from an observed mean, which shows that for most values the semi-deviation was less than the standard deviation, meaning that negative returns have less extreme values. The historical VaR, where in the case of Ethereum and Bitcoin 9.6% and 7.5%, suggests that at a 95% confidence level the cryptocurrencies will not have larger losses than 9.6% and 7.5% in a day contrasting to bond investing where the losses do not pass the 0.4% in a day. The CVaR, represents the expected loss if the worst case happens, reaching 15.6% and 12.1% in the case of Bitcoin and Ethereum. The maximum drawdown shows that Ethereum and Bitcoin dropped 273.5% and 177.4% from the highest point in the sample and the average drawdown was 115% and 69.2% respectively. Furthermore, the DaR indicates that Bitcoin and Ethereum take the longest to recoup their losses and the CDaR shows that both assets also have a bigger average of drawdowns.

Dynamic beta

As expected, the results show similar behavior of the risk measurements. Both Bitcoin and Ethereum show much larger values than one, indicating much higher riskiness than the overall market. Also, most investment strategies are relatively riskier than the overall market, yet to a lower extent than cryptocurrencies.

Portfolio analysis

From the tables above we can conclude

Firstly,annualized returns are better with only one or both cryptocurrencies, except for the minimum variance portfolios and very risk averse investors relative to the benchmark portfolios (only ETFs). However, in most cases, this was at the expense of an increase in annualized volatility (Baur et al., 2022).

Secondly, when comparing portfolios with Bitcoin and with Ethereum, when investors seek performance, Ethereum-only portfolios are better, although, with higher risk aversions, investors should focus more on Bitcoin.

Thirdly, the investors that benefit the most from the adoption of cryptocurrency are bond investors with the highest improvement in the Sharpe ratio, followed by real estate, dividend investors, value investors, growth investors, and ESG investors. However, for bond and real estate to get such improvement, investors should only invest in cryptocurrency.

Fourthly, bond and real estate should, in most cases, allocate close to 50% in each cryptocurrency, dividend investors with Wbtc=0.389 and Weth=0.418, value investors should allocate Wbtc=0.348 and Weth=0.383 and ESG and growth investors are the ones that allocate the lowest percentage in cryptocurrencies with Wcryptocurrencies=0.091 for ESG and Wbtc=0.220 and Weth=0.246 for growth investing. Therefore, the allocations found for growth investing are relatively close to what Conlon et al. (2020) found for CSI 300 of 16% and 14% for Bitcoin and Ethereum, respectively.

Overall, the portfolio results are in line with those presented by Baur et al. (2022), Borri (2019), Demiralay and Bayracı (2021), and Kajtazi and Moro (2019).