Equity analysis- Jerónimo Martins

This research was based on the assumptions of an equity research of BPI bank.

Top-down analisis

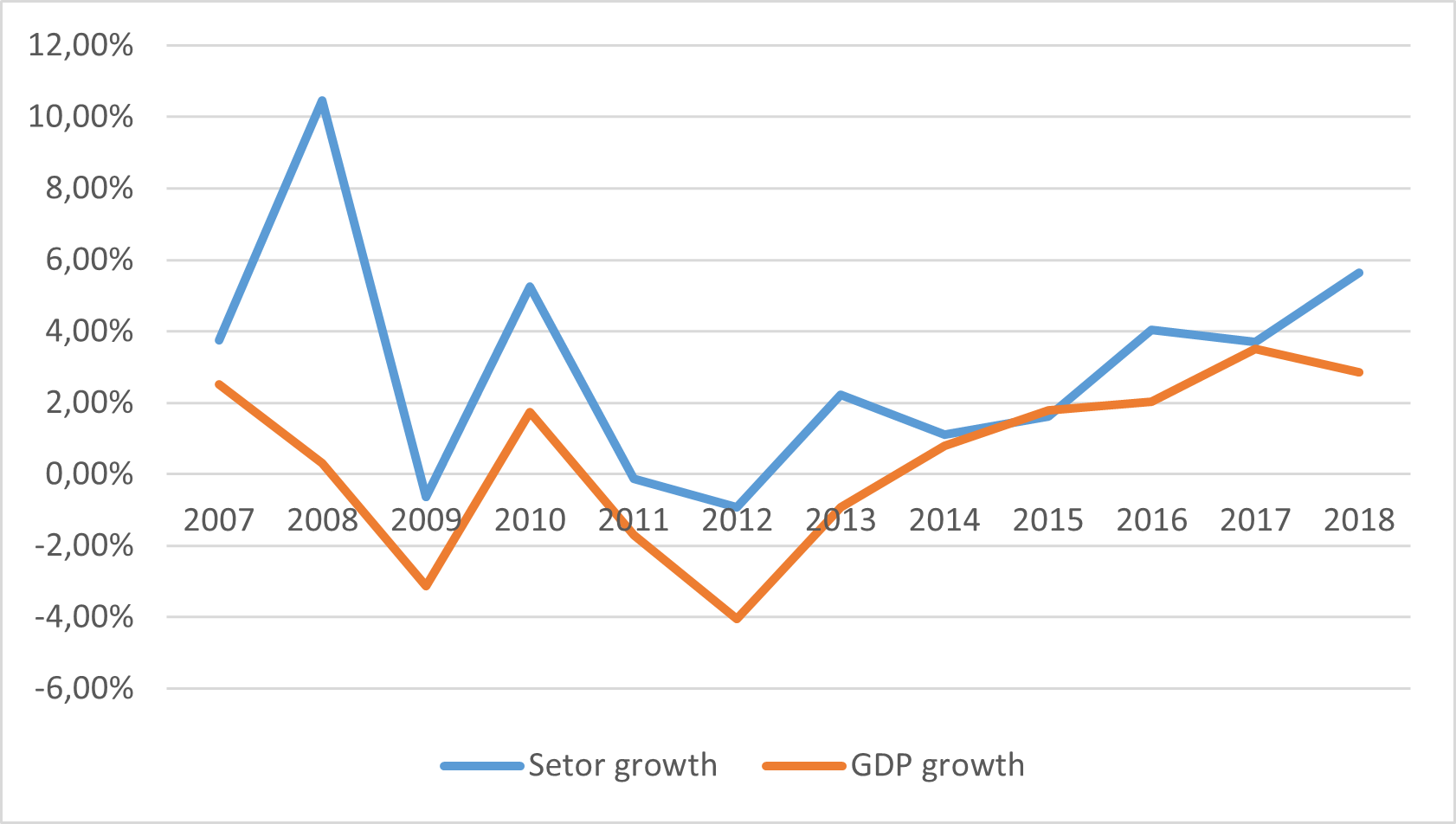

We can see that there is similar movements between both the setor and gdp growth. Howerver, the average setor growth was 3% in contrast to the 0,5% growth of the economy. Since the model uses 2017 has the last year of the model, we will assume the growth rate of the economy at that year (2%).

Financial indicators

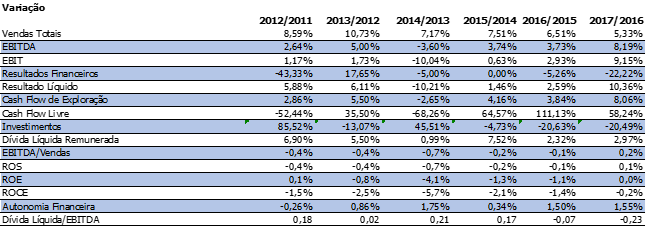

The company's total sales have been increasing since 2011 and this growth is expected to continue until at least 2017. EBITDA allows us to assess a company's overall financial performance and profitability. We can easily understand that the 2011 EBITDA increase, but in 2014 a decrease is expected (EBITDA variation of the year 2014/2013 of -3.60%), however it is expected a total recovery in 2015. Operating cash flow has been steadily increasing since 2011 with the exception of what was expected for 2014 (659 million euros), demonstrates the company's strong capacity to generate cash. The dividends per share, despite having decreased in 2012, is expected to remain stable at 50%. In fact, the ratio is considered reasonable and a factor for attracting dividend investors.

With regard to turnover, analysts estimate a sustained growth of 2%. These figures are expected, taking into account the history of sustained growth in the company's sales in recent years. As for EBITDA, it is expected a value of 777 million euros in 2015, that is, about 3.74% above the value of the previous year.

Jerónimo Martins has been creating a permanent improvement in efficiency, achieved through the reduction of operating costs. It is estimated that this efficiency will be reflected in EBITDA, which is expected to reach an approximate growth of 8.19% in 2017 compared to the previous year, reaching an amount of 872 million euros.

Multiples analisis

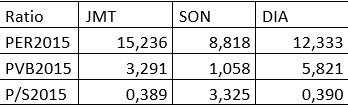

Regarding the PER, Jerónimo Martins presents the highest value due to a greater growth with BPI's estimates in relation to other companies. In fact, Jerónimo Martins is expected to grow at 8%, while DIA only at 4% and Sonae at 3%. In this sense, with the PER being the number of years needed to recover the investment, given current results, we found that the most attractive investment in this regard would be Sonae, given that it has a faster return on investment. In the case of the other two stocks, they present values above the average PER of 12.13, being considered more expensive investments. Regarding the PBV, it allows us to understand the value of equity relative to the book value. In this sense, if we consider a benchmark below 1 as an attractive investment, we find that none of these companies meet this criteria. However, considering the average of the three companies (3.39) we found that Sonae is the most attractive investment. Finally, taking into account the P/S, it is observed that Jerónimo Martins is the most attractive investment since investors are paying the lowest value for each euro of sales.

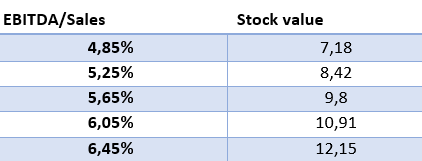

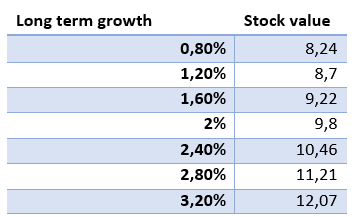

Sensitivity analises

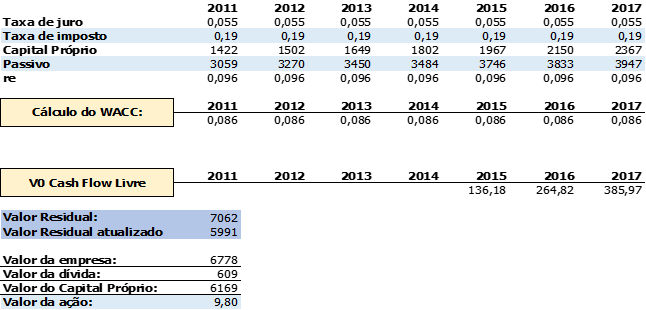

Free Cash Flow

In this case, taking in to account that the price of the stock was 8,38 in 17 of outuber 2014, the decision is to buy the stock since it is expected a return of 17%.